What to Do When a Client Doesn't Pay: A Freelancer's Action Plan

Learn the 6-step system to collect overdue payments from clients. Professional follow-up, demand letters, and legal escalation strategies for freelancers.

Updated on

2026-02-05

Learn the 6-step system to collect overdue payments from clients. Professional follow-up, demand letters, and legal escalation strategies for freelancers.

Updated on

2026-02-05

Find the low-hanging, quick-wins and 10x your freelancing business!

Get the ChecklistYou just sent an invoice for $2,500 of work you finished last week. It's now 15 days overdue. Your client isn't responding to messages. Your rent is due in two weeks.

This is the moment where most freelancers either panic or give up. But you're going to do something else: follow a system.

Non-payment is one of the top income stability threats for solopreneurs. It feeds that feast-or-famine cycle you're probably tired of experiencing. Most freelancers delay action because they don't know what steps are actually legal and effective.

According to Alfa Law Firm, having well-drafted contracts and clear action plans prevents payment disputes from becoming crises. The good news? You can transform non-payment from a devastating crisis into a manageable problem with predictable next steps.

This guide is for intermediate freelancers (developers, designers, writers, marketers) who spend more time hunting for work than they'd like. If you've got 2-5 years of experience and earn a decent chunk of your income from freelancing, this is for you.

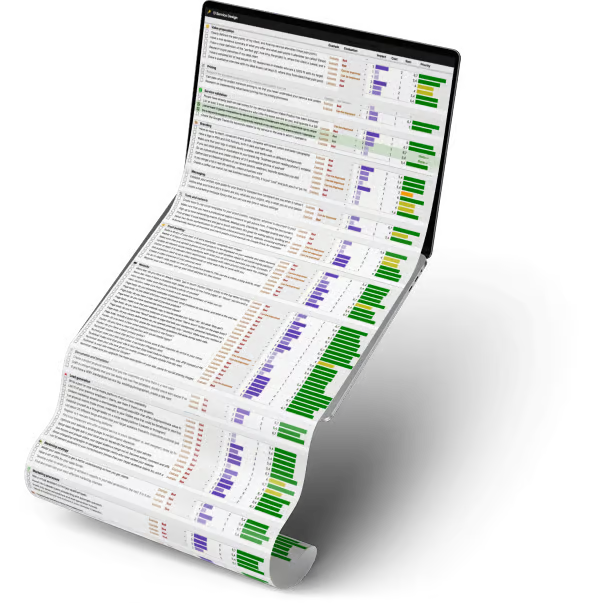

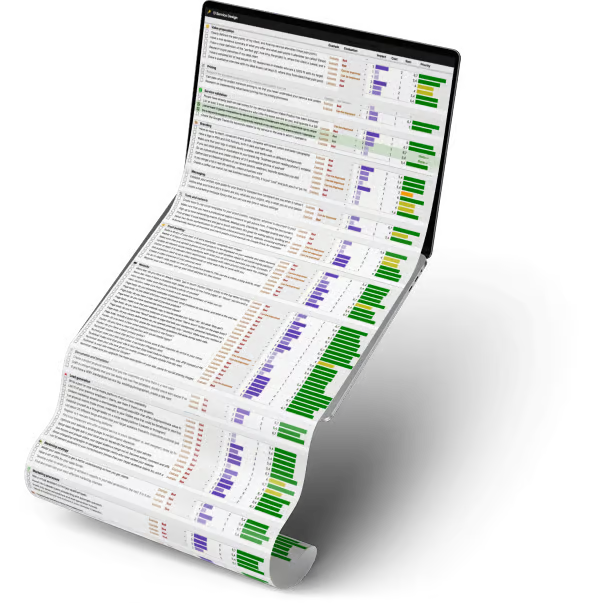

Here are 6 concrete steps that move from soft contact to legal recovery. Each step has a clear timeline so you know how long to expect. This plan works for invoices ranging from $500 to $5,000+.

You'll need a few things before diving in:

Required Materials:

Small claims court (usually for $500 to $10,000) is free or low-cost. Anything larger may need a lawyer. This plan assumes the client is legitimate (not a scam) and operating in your country or state.

Common Worries Addressed:

"I don't have a formal contract." You can still use email agreements or invoice language as evidence. The Roanoke Star's coverage of freelancer legal rights confirms that documented agreements help in legal proceedings.

"I'm worried about damaging the relationship." Professional follow-up actually preserves relationships better than silence. Carmine Mastropierro notes that clear communication demonstrates professionalism.

"I don't have time for legal stuff." This plan is designed for solopreneurs with limited time. Each step takes under an hour.

Most non-payment happens because of administrative delays, not malice. Your first job is to re-establish contact in a way that documents your attempt and signals professionalism.

What to Do:

Send 2-3 structured payment reminder messages. Not angry. Not casual. Professional.

Why This Matters:

Documentation of your follow-up efforts is legally valuable if this escalates. A professional tone keeps the door open for negotiation. Alfa Law Firm emphasizes that documentation of all communications is vital for legal action.

How to Do It:

Message 1 (Day 1): Simple invoice reminder

Hi [Name], I wanted to follow up on Invoice #123 for $2,500, which was due on [date]. I know things get busy. Could you confirm when I can expect payment? Thanks!

Message 2 (Day 3): Slightly more formal

Hi [Name], I'm following up again on Invoice #123 for $2,500. The payment is now [X] days overdue. Please let me know if there's an issue I can help resolve or confirm a payment date. I appreciate your prompt attention to this.

Common Mistakes:

Expected Outcome:

Many clients will respond to these reminders and pay. Carmine Mastropierro reports that most non-payment issues stem from administrative delays rather than intentional non-payment. If you get no response after two attempts, move to Step 2.

Success Indicator:

You've documented two good-faith attempts to collect payment. Even if the client doesn't respond, you're building a paper trail.

Now it's time to reference the payment terms you already agreed on. This step shows you're serious without being hostile.

What to Do:

Send a message that directly references your contract's payment terms and late fees (if applicable).

Why This Matters:

Contracts define scope of work, payment terms, deadlines, and dispute resolution, according to The Roanoke Star. Referencing them shows you know your rights. Late payment fees serve as deterrents and establish professionalism, notes Alfa Law Firm.

How to Do It:

Hi [Name], Invoice #123 for $2,500 is now [X] days overdue. Per our agreement signed on [date], payment was due on [date]. Our contract specifies a [X%] late fee after [X] days. I'd prefer to avoid adding fees. Please remit payment by [specific date] or contact me to discuss a payment plan.

Attach a copy of the signed contract or relevant email agreement.

Common Mistakes:

Expected Outcome:

This message often prompts payment or opens a conversation about payment plans. Some clients genuinely forgot or had cash flow issues.

Success Indicator:

The client either pays, proposes a payment plan, or continues to ignore you. If they ignore you, you're ready for Step 3.

A demand letter is a formal, written request for payment. It creates a legal record that demonstrates you attempted to resolve this before involving courts or collection agencies.

What to Do:

Send a formal demand letter via email and certified mail (if possible).

Why This Matters:

According to Ruul's legal guide, formal demand letters establish legal records before escalation. Alfa Law Firm adds that demand letters demonstrate seriousness and set final deadlines.

How to Do It:

Your demand letter should include:

Keep it factual and professional. No emotional language.

Common Mistakes:

Expected Outcome:

Many clients pay after receiving a demand letter because they realize you're serious. JustAnswer's legal experts note that formal demand letters should outline agreed payment before legal action.

Success Indicator:

You have documented proof that you sent a formal payment demand. This proof is critical for small claims court or collection agencies.

Find the low-hanging, quick-wins and 10x your freelancing business!

Get the ChecklistBefore going to court, consider mediation or negotiation. These options are faster and cheaper than litigation.

What to Do:

Offer the client a chance to settle the dispute through mediation or a payment plan.

Why This Matters:

Ruul reports that mediation and arbitration are quicker and less expensive than litigation. The Roanoke Star confirms that these options cost less and resolve faster than formal court proceedings. Alfa Law Firm notes that mediation can preserve working relationships while resolving disagreements.

How to Do It:

Send a message offering options:

I'd prefer to resolve this without legal action. I'm willing to discuss a payment plan or mediation. Please respond within 3 business days to arrange a solution. Otherwise, I'll proceed with small claims court or a collection agency.

Common Mistakes:

Expected Outcome:

Some clients will agree to payment plans. Get any agreement in writing. If the client continues to ignore you, it's time for Step 5.

Success Indicator:

You've given the client every reasonable opportunity to resolve this professionally. You're now justified in escalating.

If nothing else has worked, you have three main options: small claims court, binding arbitration, or collection agencies.

What to Do:

Choose the option that makes sense for your situation.

Small Claims Court:

According to Ruul, small claims court is accessible for lower-value disputes. It typically handles claims from a few hundred to several thousand dollars (varies by state).

Filing fees are usually low. You don't need a lawyer. Bring all your documentation: contract, invoices, emails, demand letters.

Binding Arbitration:

Carmine Mastropierro notes that binding arbitration clauses are faster and cheaper than litigation. If your contract includes an arbitration clause, this may be your required next step.

Collection Agencies:

Ruul explains that collection agencies specialize in debt recovery but take a percentage of what they collect. They handle the process for you, but you get less money.

Why This Matters:

You've exhausted reasonable attempts to collect. Legal action protects your right to payment and creates consequences for non-paying clients.

Common Mistakes:

Expected Outcome:

You receive payment, a court judgment in your favor, or you recover a portion of your payment through collections.

Success Indicator:

You receive payment, a court judgment in your favor, or you recover a portion through collections. The Roanoke Star notes that documented contracts provide significant advantages in legal proceedings.

The best way to handle non-payment is to prevent it in the first place. Here's how to set up systems that minimize future risk.

What to Do:

Implement these payment protection strategies:

Get Deposits:

Carmine Mastropierro recommends that deposits and milestone payments reduce non-payment risk. Require a deposit upfront before starting work.

Use Clear Contracts:

Every project needs a written agreement. The Roanoke Star emphasizes that documented contracts provide significant advantages in legal proceedings.

Your contract should include:

Build in Arbitration Clauses:

Carmine Mastropierro suggests that binding arbitration clauses make resolution faster and cheaper. Clear payment terms are critical to preventing disputes.

Use Milestone Payments:

Break large projects into phases with payment due after each milestone. This limits your exposure if a client stops paying. Carmine Mastropierro confirms that milestone payments reduce non-payment risk.

Common Mistakes:

Expected Outcome:

You'll dramatically reduce non-payment incidents. When they do happen, you'll have clear documentation that makes recovery easier.

You'll know your prevention system is working when:

"The client says they didn't receive the invoice."

Resend it immediately with delivery confirmation. Keep records of all sending attempts.

"The client disputes the quality of work."

This is why documentation matters. JustAnswer's legal experts recommend escrow arrangements for disputed deliverables. Review your contract's dispute resolution clause.

"The client agrees to pay but keeps missing deadlines."

Get the new payment date in writing. If they miss it again, proceed immediately to the next escalation step.

After implementing this action plan:

For ongoing protection, Carmine Mastropierro mentions that services like LegalShield offer affordable alternatives to hiring lawyers for contract review and collection support.

Non-payment doesn't have to derail your freelance business. With this action plan, you can handle late payments professionally and protect your income.

The key is acting quickly and following a system. Most clients will pay after professional follow-up. For those who won't, you have clear escalation options.

Remember: you did the work, you deserve to be paid. Following this plan shows you're a professional who takes payment seriously.

Now go set up those prevention systems so you spend less time chasing payments and more time doing the work you actually love.

Join 20.000+ freelancers in our weekly value bomb, and grow your frelance income with confidence!

By entering your email address you acknowledge to subscribe to the FreelancePizza mailing list.

You will be sent a confirmation (opt-in) email to confirm your email. You can unsubscribe any time.